As the year comes to a close we take another look at the implications of the drop in oil prices. Nick discusses the implications of the continued drop in oil and the potential opportunities it poses for the value minded investor.

Chart of the Week: The Mastery Gap

Taking the discussion further from two weeks ago on the Conscious Competence Learning Model, Rick explains where many leaders fail to leverage the learning from the model to apply it to their leadership and organizations. Listen to this week's Chart of the Week to learn where the Mastery Gap is and understand how you can challenge yourself in your leadership.

Chart of the Week: The Price of Oil - Winners and Losers

Almost everyone is feeling good about the prices at the gas pump these days, reflective of the price of oil that has dropped precipitously over the last few months. Who wins and who loses, however, is worthy of discussion and in this weeks' installment of the Chart of the Week, Nick walks us through who is on which side of the equation.

Chart of the Week: The Conscious Competence Learning Model

In a bit of a changeup this week, Rick will be leading the discussion of the Conscious Competence Learning Model, useful for understanding how and what we learn both from an individual leadership and an organizational perspective. Listen in to learn how you can apply what and how you've learned in 2014 to propel your 2015 initiatives, ensuring you are maximizing the potential of your business in the coming year.

Chart of the Week: Time Horizon - Why Patience Matters

In spite of the repeated learning and profound wisdom in the financial markets around the perils of short term thinking and the merits of long term thinking, inevitably investors still make poor decisions. Whether it is out of boredom and the lure of the shiny object, or fear that drives one to irrational decision making, poor investment decisions prevail. What can we learn from this? In this week's installment Nick focuses on what it takes to overcome these behavioral pitfalls to truly reap the benefit of good long term thinking and investment strategy.

Chart of the Week: Equities - It's Not Always About Being Cheap

Chart of the Week: Election Day 2014 - It Really Doesn't Matter

Chart of the Week: Fed Meeting Today - Trick or Treat?

The Federal Reserve met today to discuss among other things, whether to continue the Quantitative Easing (bond purchasing program). As we wait with baited breath on the outcomes of the meeting, we will be contemplating the implications of continued over-sweetening of the markets, or if the promise of ending QE is more trick than treat.

2014 Q3 Commentary: Heads We Win, Tails We Don't Lose Much

With major stock market averages in the midst of a pullback, I thought it would be interesting to review the risks we have seen in the markets. As of this writing the S&P 500 dropped below its 200 day moving average for the first time in 477 days (third longest streak in history). Small cap stocks have been especially susceptible (down 13%+ on a price basis since end of June). This pullback is no coincidence, the stock markets domestically and internationally have benefitted from the global experiment of Quantitative Easing. Indeed the correlation of increasing stock prices in the midst of each round of quantitative easing is unmistakable. Likewise, the subsequent fall of stock prices, as each round has ended is distinct. Therefore, with the end of QE3+ on the horizon, there is no wonder that stock prices are under pressure.

Are You Playing to Win, Or Trying Not to Lose

It’s not a matter of if you will fail, but when failure will be upon you. Knowing this, the challenge then becomes learning how to respond in the face of failure. How you respond in the face of challenge and failure will define your character and whether you succeed, or not. But getting past the failure to get to success? There are no shortcuts. Nor are there any guarantees that you will eventually “get it.”

2014 Leadership & Economic Summit

Every business leader today, no matter the industry, faces the challenge of keeping up with advancing technology trends while staying competitive in a shifting economy. Here in Oregon, where the pioneering spirit still prevails, the thriving sectors of food, healthcare, and technology are leading the way.

The 2014 Leadership & Economic Summit will feature a keynote address from economist John Mitchell, followed by a panel discussion with business leaders from three very different industries all of whom are challenging and disrupting their markets in profound and original ways. Listen in as Dave Sanders of ZoomCare, Frank Helle of Axian Software, and Jeff Harvey of Burgerville discuss the challenges and opportunities that come with embracing unique business models to create success in today's consumer-driven markets.

Chart of the Week: The Benefits of Asymmetric Risk

The information in this video is intended for residents of the United States and is not intended to be personalized nor is it a recommendation to buy or sell securities. Pilot Wealth Management is a Registered Investment Advisor, licensed with the State of Oregon and will ensure proper licensing or exemption from licensing before conducting business in any other state.

Chart of the Week: The Meat and Potatoes of Inflation

In an ode to Portlandia this week, Nick and Rick discuss food and in particular, the increase in food costs that have clearly outpaced wage growth this year. What does this mean to overall demand in the economy and is it a portend of broader inflation and interest rates? Listen to the discussion and determine for yourself what the implications are of the price of that free range, all natural chicken you just bought at the grocer.

Chart of the Week: Small Cap Underperformance

Chart of the Week: The Investor Behavior Penalty

Chart of the Week: Sequence of Return Risk - Timing Matters

In this weeks installment, we discuss the implications of the sequence of risk to returns and how they can translate to dramatically different results in the portfolio over time. Learn how restraint from the shiny object syndrome and a focus on undervalued equities can be the key differentiators to ensuring you are properly hedged for risk, in whichever sequence risk is encountered.

Chart of the Week: Dry Powder - Why Now More Than Ever

2014 Q2 Commentary: Everything Changes ... Eventually

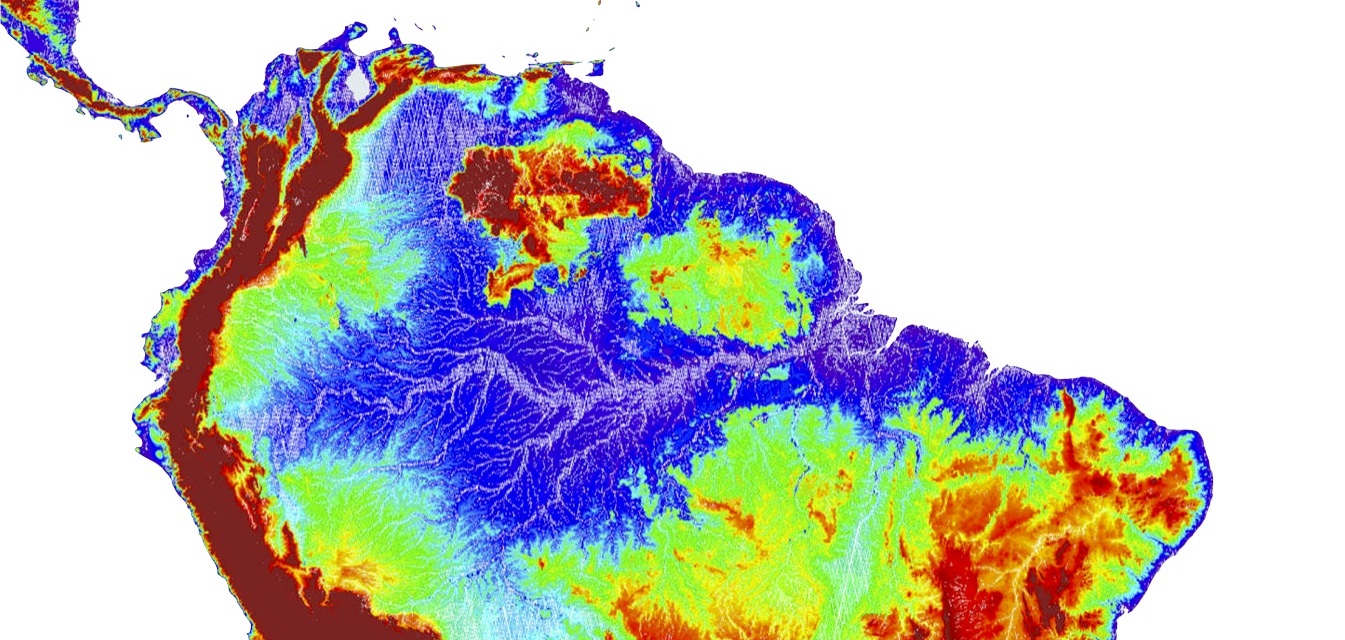

As recently as 10 million years ago, the Amazon river actually flowed east to west. At the base of the northern Andes, it formed a large lake that eventually flowed into the Caribbean Sea. Over time, it reversed course as the continent tilted and sediment built up. If the largest river on the planet can change directions - couldn’t the stock market?

The Cost of Not Getting It

While I am not a fan of reality TV, I have to confess my devotion to a couple of shows that have an entrepreneurial bent – ABC’s Shark Tank and CNBC’s The Profit. Reality drama aside however, both shows are a study in competency, business model execution, and commitment of the business owner or would-be-entrepreneur. What I have noticed from watching episodes of both shows is a common description Lemonis and the Sharks use to describe someone who is failing; they are someone who just doesn’t get it. At some point I adopted the use of this phrase and have used it to label a condition where the business owner or employee is clearly failing. But what does it really mean, to not get it? And more to the point, what if I’m the one not getting it?

Chart of the Week: Midpoint 2014 - Investor Complacency

In this week's chart review on margin debt in the NYSE and S&P, Nick discusses the implications of investor complacency in the equities markets and why this is something to pay attention to. We also refer to an earlier COTW discussion on the Perils of Prediction with regard to returns which is relevant to this week's discussion.