By Nick Fisher, Portfolio Manager

“We will continue to ignore political and economic forecasts which are an expensive distraction for many investors and businessmen. Thirty years ago, no one could have foreseen the huge expansion of the Vietnam War, wage and price controls, two oil shocks, the resignation of a president, the dissolution of the Soviet Union, a one-day drop in the Dow of 508 points, or treasury bill yields fluctuating between 2.8% and 17.4%. . . . But, surprise-none of these blockbuster events made the slightest dent in Ben Graham’s [value] investment principles.”

The value investment principles of Ben Graham, Warren Buffett's mentor and predecessor are simple: buy investment securities that, upon thorough analysis, provide safety of principle and a satisfactory return. As we have discussed ad nauseam, a business' intrinsic value fluctuates very little. Yet, the price that the ever-moody "Mr. Market" will pay at any given time can fluctuate dramatically based on outside economic and political forces.

This fluctuation can stir up our deeper anxieties and activate the human compulsion to develop a reactionary narrative, which the press is more than willing to provide. In the end, it's just noise.

At Pilot Wealth, we feel no need to explain it, no need to tell a story. Instead, we recognize volatility happens and we welcome it.

Since we can do very little to influence the actual intrinsic value of the businesses we invest in, our work is limited to estimating our range of intrinsic value. We then focus on price. When prices drop we get a little more excited, just as we did in the 1st quarter of 2016. When prices rise, as they have recently, we harvest gains and raise cash. It's that simple: buy low, sell high.

The fear of missing out (FOMO) is real. While FOMO's effect on social interactions is well known, its effect on investing is perhaps lesser known.

Here's how FOMO's effect on investing often plays out: After watching other investors do quite well in the market, you begin to wonder out loud, "Am I doing the right thing? Other investors are making a lot of money while I am harvesting gains, selling as the market rises and holding cash. Cash earns nothing, and zero return does not improve my retirement outlook...and (insert acquaintance) are doing so well they just bought a vacation property! Ugh, I simply can't sit here and do nothing...get me some of that Facebook, Amazon, Netflix and Google. While we're at it, how 'bout some biotech - oh and throw in some money in the startup that my neighbor just invested in. And to make sure we are properly diversified, we'll flip a house for good measure."

Stop the madness!

Let me offer an alternative scenario as investing in the riskiest investments this late in the market cycle will offer a very lopsided risk and reward - the result of which could put you in the "unlucky" category.

Let's look at Jane and Joe:

Both investors invested/saved the same amount of money over 40 years, both had an identical return of 8% annually after fees (5% after inflation), so why did Jane have 50% more money than Joe when she retired?

The answer: Joe achieved higher returns early in his career, while the last ten years of his returns (when he had the most money) were poor, just as they are likely to be now. Jane earned very poor returns early in her career, but great returns in the last 10 years when she had the most money built up in her savings.[1]

We call this sequence of returns risk. It is an issue that has been downplayed until recently. The discussions within academic journals have highlighted that when retirees enter the withdrawal phase where they are drawing on their investments, poor returns (losses) early on can pose a significant risk to retirement and make it much more likely that a retiree runs out of money.[2]

What most academics and advisors have missed is that sequence of returns matter significantly whenever cash flows matter. Cash flows matter just as much in the 10 years leading up to retirement, as they do in the first years of retirement.[3] When Joe has done everything else right in terms of saving and investing, the sequence of his returns are just plain "unlucky." Perhaps this is why Warren Buffett says rule #1 of investing is: "Don't lose money..." and rule #2 is: "Don't forget rule #1."

This late in the market cycle, with interest rates still at generational lows, the amount of liquidity chasing "deals" is ridiculous! As advisors who help clients make decisions across the spectrum of investments, the potential returns we see are very low compared to 4 or 5 years ago. It doesn't matter what type of investment we are talking about (stocks, bonds, private equity/angel investments, real estate investments, etc). The likelihood of making an acceptable return in any asset class on the risky end of the capital markets line is very low.

A blogger that I follow has tongue in cheek refereed to this current environment as "the everything" bubble. While I don't believe we are in bubble like conditions (where an investor will pay anything to get in an investment, regardless of price), prices are high enough that sub-optimal returns are likely.

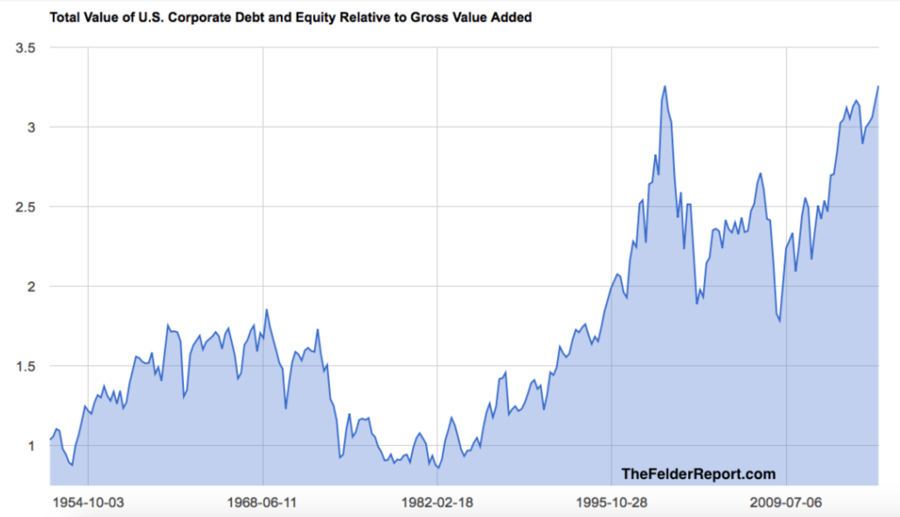

The following chart shows the total value of US companies debt and equity compared to the goods and services produced. By this measure, we are very close to valuations during 1999/2000 (note that this is not measuring dotcom companies alone, but rather the overall market of corporate debt and equity).

This next chart shows four other valuation measures showing varying degrees of overvaluation of the stock market. US stocks right now are approximately 2 standard deviations above their long-term average valuation.[4][5]

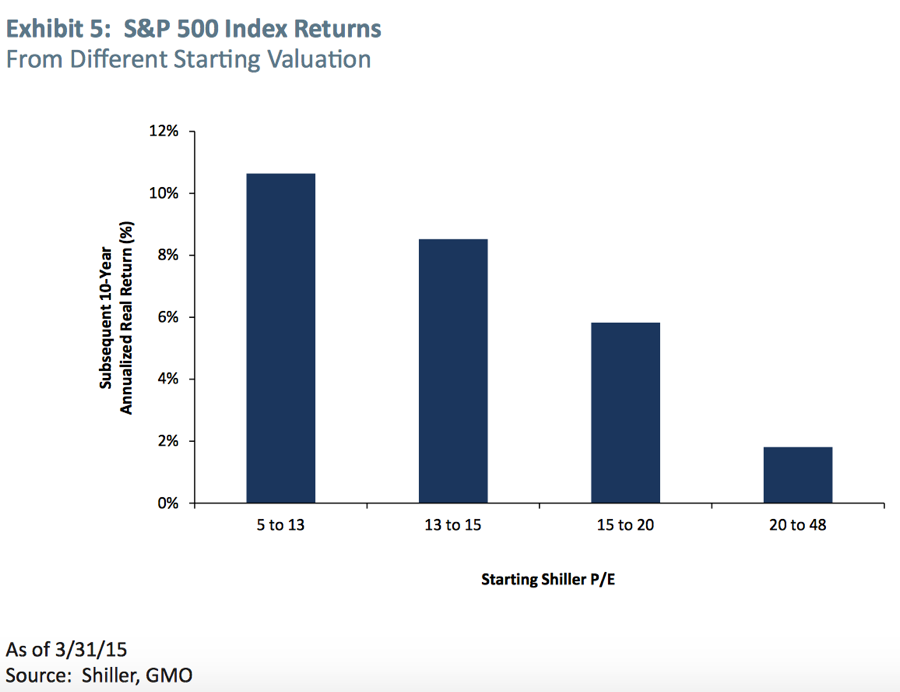

The data supports the fact that valuation matters. The higher the valuation, the lower your long-term expected returns. In other words, in this environment you are more likely to end up like Joe if you are nearing retirement. The following chart shows pretty clearly that extreme valuations can lead to very different return outcomes.

Other assets are equally as frothy and just as likely to lead to below average returns. When will the market become more attractive? We have no idea. In the absence of a plan, many unsuspecting investors will likely experience returns that will put them in the unlucky category of Joe.

How do we avoid being unlucky? We can only maintain our price discipline and invest in an absolute return manner. This means that we are vigilant in our search for what will offer the best risk adjusted returns going forward and that meets the investment definition that Benjamin Graham so aptly mandated "safety of principle and adequate return."

Investment Review

Recently I was reading about the top mistakes that ultra high-net worth investors make and they included not having enough cash (dry powder) for new opportunities; we won't suffer from that mistake. Our biggest mistake has been not allocating enough capital to the opportunities we have found attractive. This clarity comes to us through hindsight, of course.

The beginning of 2016 had plenty of volatility. However, this was not nearly as unique as you might think. Volatility frequently occurs in the market. The best cure for this volatility is having cash and fixed income securities for diversification. While cash has done well (on a relative basis to other currencies), it hasn't done absolutely well compared to our equity holdings.

Indeed, cash has served us very well in the last 3 years as a tool to take advantage of opportunities as they have presented themselves. The value of the dollar has been on a tear during this time frame (up more than 24% compared to other global currencies). While we don't get much credit for this unless we are able to put it to work, it has increased the opportunities immensely in other assets.

We have heard for years that interest rates would be rising and bonds/fixed income was a lousy investment. We did not waver in having a healthy allocation to fixed income/bonds. Last quarter we mentioned the importance of finally changing this stance. After interest rates rose substantially, our fixed income managers did a marvelous job on the year and beat their benchmarks after fees by a sizable margin. This represents a real value add to client portfolios.

After having an unremarkable 2015, we more than made up for this with our equity performance in 2016. We acquired undervalued investments and continued to buy on the way down. As a result, we had some temporary losses in portfolios. In 2016 many of the purchases we made rebounded substantially, especially financials and energy stocks in the 4th quarter.

2015 and 2016 offered a very interesting contrast of the binary market sentiments: some areas of the market were loved, while others were hated. We were able to make incremental adjustments to portfolios to take advantage of short-term changes in investor sentiment. As our own worst critic, we should have been more aggressive. But while we were fairly conservative, we are more than pleased with our overall portfolio returns. Our conservative nature will serve us well in the coming years. In a market that could be moving sideways for a while, we view the incremental moves as critical to providing significant value to our clients.