An annual ritual in corporate America happens each year when leaders of publicly traded companies summarize their reflections on the prior year, and outline plans for the coming year. Preceding the annual report, their letter is published for current and would be shareholders to review, and subsequently judge the merits of owning shares in the company. What if you had to write a letter to shareholders discussing the merits of owning shares in your business? Doing so may be the MOST important thing you do for your business in 2014.

On a basic level, a letter should include the following:

Remind shareholders why you exist

Review the strategy for the last 5 yrs

Explain & Reconcile the key outcomes

Outline the strategy for the next 5 yrs

The process begins with self-awareness. It may be the most critical component in understanding where you are, and therefore where you are going. I am reminded of a current client who had a "successful" distribution business. The only problem was that he didn't seem to be making progress. He considered hiring a CFO to help understand what was going on financially. He agreed instead to a facilitated assessment in which we engaged in a critical look at both his and the businesses short-comings. The assessment revealed not only a lack of financial awareness but also a lack of understanding of who controlled the value chain within his industry. As a result, he initiated a multi-year strategy focusing on how to leverage his strengths in these areas. The outcome of this strategy will nearly double his profit margins, and secure his long-term sustainability. His strategy included: a) proactively managing and gaining more control over his supply-chain, b) recapitalizing his company to reduce the risk of an economic downturn, while becoming less dependent on debt financing and c) focusing on his most important financial metrics, rather than the "cool" projects to promote his company.

A long-term view is significant as it is too easy to focus on the short-term, while sacrificing long-term sustainability and investment in the future. Most small and middle market companies have thought very little about their strategy. Most are opportunists, where they see a customer need and attempt to meet that need, taking on projects to build systems around their product or service. While this is how most companies are created, a more intentional and sophisticated strategy is critical to building a sustainable and valuable company. Consider IBM's strategy from their 2012 Letter to Shareholders:

IBM's Model: Continuous Transformation

In an industry characterized by a relentless cycle of innovation and commoditization, one model for success is that of the commodity player - winning through low price, efficiency and economies of scale. Ours is a different choice: the path of innovation, reinvention and shift to higher value.

If you understand your industry, your company's current position and resources, then you can plot a course going forward. In IBM's case, they have elected to deemphasize slow growing, low margin business sectors, like their hardware business which was formerly a huge component of their total business. Instead, IBM chooses to focus on the higher growth and higher margin business segments. An objective look at your business is critical. Often times a board of advisors, mentors and/or outside consultants can assist best with this assessment.

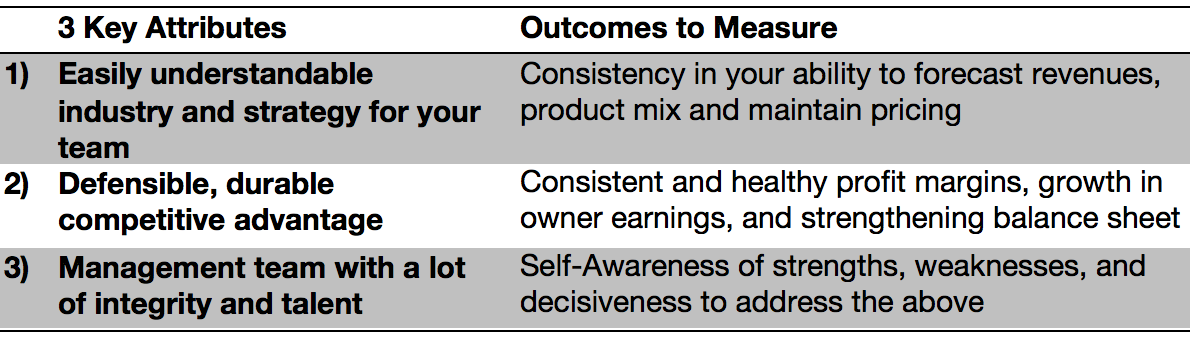

Understanding what outcomes to measure is vital. In our view there are three key attributes and outcomes that make a great company:

Screen Shot 2013-12-30 at 11.01.36 AM

The process of constructing a letter to your shareholders can be a very useful exercise. A well crafted letter should include a summary of all the information needed to evaluate the investment in a business. It should allow an outsider to determine the value of your business. If you cannot articulate this, your business may not be worthy of investment. Remember, we are investing considerable time and money in our businesses on a daily basis. Is your business worthy of this investment? Whether or not you intend sell your stake in your business or use it as a tool to build wealth, answering this question on an annual basis is imperative to reaching your goals.