It’s not a matter of if you will fail, but when failure will be upon you. Knowing this, the challenge then becomes learning how to respond in the face of failure. How you respond in the face of challenge and failure will define your character and whether you succeed, or not. But getting past the failure to get to success? There are no shortcuts. Nor are there any guarantees that you will eventually “get it.”

2014 Leadership & Economic Summit

Every business leader today, no matter the industry, faces the challenge of keeping up with advancing technology trends while staying competitive in a shifting economy. Here in Oregon, where the pioneering spirit still prevails, the thriving sectors of food, healthcare, and technology are leading the way.

The 2014 Leadership & Economic Summit will feature a keynote address from economist John Mitchell, followed by a panel discussion with business leaders from three very different industries all of whom are challenging and disrupting their markets in profound and original ways. Listen in as Dave Sanders of ZoomCare, Frank Helle of Axian Software, and Jeff Harvey of Burgerville discuss the challenges and opportunities that come with embracing unique business models to create success in today's consumer-driven markets.

Chart of the Week: The Benefits of Asymmetric Risk

The information in this video is intended for residents of the United States and is not intended to be personalized nor is it a recommendation to buy or sell securities. Pilot Wealth Management is a Registered Investment Advisor, licensed with the State of Oregon and will ensure proper licensing or exemption from licensing before conducting business in any other state.

Chart of the Week: The Meat and Potatoes of Inflation

In an ode to Portlandia this week, Nick and Rick discuss food and in particular, the increase in food costs that have clearly outpaced wage growth this year. What does this mean to overall demand in the economy and is it a portend of broader inflation and interest rates? Listen to the discussion and determine for yourself what the implications are of the price of that free range, all natural chicken you just bought at the grocer.

Chart of the Week: Small Cap Underperformance

Chart of the Week: The Investor Behavior Penalty

Chart of the Week: Sequence of Return Risk - Timing Matters

In this weeks installment, we discuss the implications of the sequence of risk to returns and how they can translate to dramatically different results in the portfolio over time. Learn how restraint from the shiny object syndrome and a focus on undervalued equities can be the key differentiators to ensuring you are properly hedged for risk, in whichever sequence risk is encountered.

Chart of the Week: Dry Powder - Why Now More Than Ever

2014 Q2 Commentary: Everything Changes ... Eventually

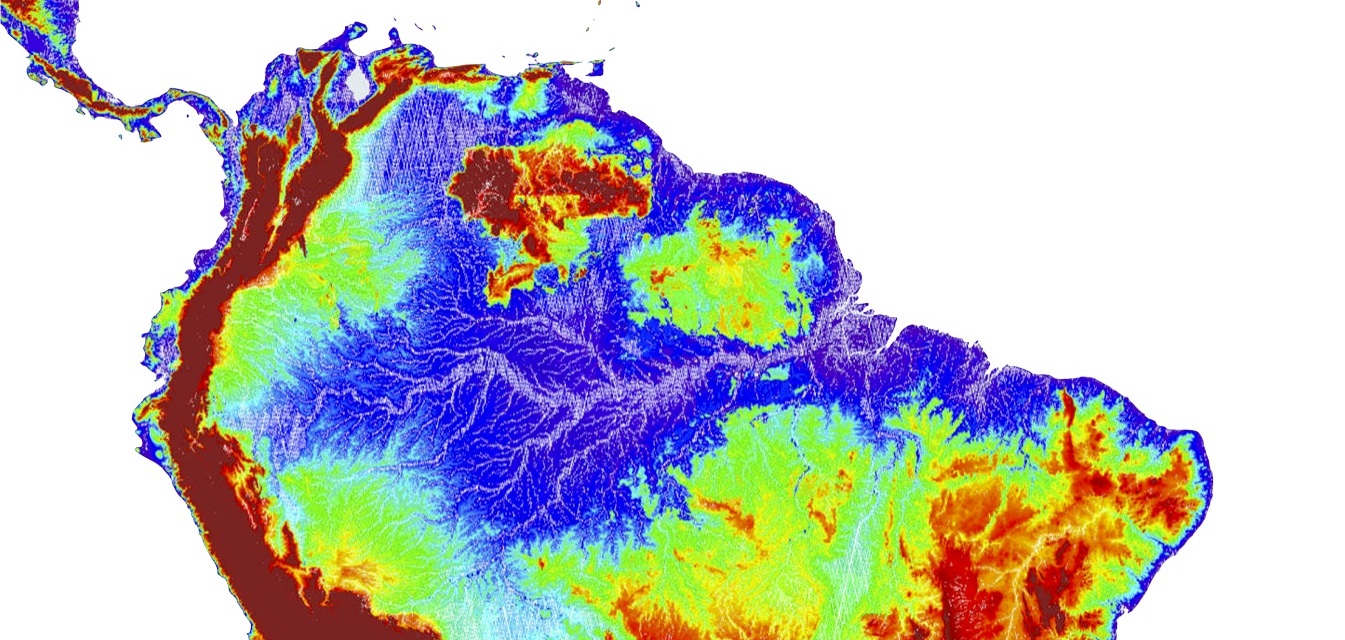

As recently as 10 million years ago, the Amazon river actually flowed east to west. At the base of the northern Andes, it formed a large lake that eventually flowed into the Caribbean Sea. Over time, it reversed course as the continent tilted and sediment built up. If the largest river on the planet can change directions - couldn’t the stock market?

The Cost of Not Getting It

While I am not a fan of reality TV, I have to confess my devotion to a couple of shows that have an entrepreneurial bent – ABC’s Shark Tank and CNBC’s The Profit. Reality drama aside however, both shows are a study in competency, business model execution, and commitment of the business owner or would-be-entrepreneur. What I have noticed from watching episodes of both shows is a common description Lemonis and the Sharks use to describe someone who is failing; they are someone who just doesn’t get it. At some point I adopted the use of this phrase and have used it to label a condition where the business owner or employee is clearly failing. But what does it really mean, to not get it? And more to the point, what if I’m the one not getting it?

Chart of the Week: Midpoint 2014 - Investor Complacency

In this week's chart review on margin debt in the NYSE and S&P, Nick discusses the implications of investor complacency in the equities markets and why this is something to pay attention to. We also refer to an earlier COTW discussion on the Perils of Prediction with regard to returns which is relevant to this week's discussion.

What College Never Taught Me About Business

June has been a busy month in our household with two graduations to celebrate; our oldest from college and our youngest from high school. As much as my wife and I are excited for the future that lay ahead of them, it is not without apprehension.

I have laid awake at night wondering if they are adequately prepared to enter the workforce and be the self-sustaining, contributing members of society we hope they’ll be. Regardless, I found myself writing a top ten list the other day of what twenty-eight years in business and adult life has taught me, with the thought that it will be needed soon.

Chart of the Week: Investing - It Pays to be Nimble

Chart of the Week: Corporate Profits - Why Do We Care

Chart of the Week: YTD Bond Returns - The Perils of Prediction

Rarely is our attention captured by a short term chart, however, in the following from Bloomberg it illustrates the significant appreciation in long term Treasury bonds since the beginning of the year. Not only was this unanticipated, but the opposite was the prediction from most experts. Validity of predictions aside, it does beg the question what should be done with positions that are long on bonds? Listen to the following discussion and hear what Pilot's Portfolio Manager, Nick Fisher, has to say.

5/20/14 Chart of the Week: Not All Markets Are Overvalued

If valuations actually matter anymore, and the U.S. is in fact overvalued - then what do we want to buy? This week we look at cyclically adjusted price-to-earnings ratios (CAPE) of other foreign markets and the returns that they generate. Fittingly, we also discuss the difference between risk, volatility, and the permanent loss of capital.

5/13/14 Chart of the Week: Cov-lite and Why We're Lightening Up

Cov-lite lending and commercial loans have grown quite a bit in the last couple of years. This week, we discuss what covenant light commercial loans are, how they are made, and how the risk is mitigated by lenders. All of this of course informs our risk vs. return assumptions and the evolution of our fixed income allocations.

Navigating Conflict & Fostering a Collaborative Culture: Senior Leader Lab - Part 3

Successful business owners and leaders recognize that leadership effectiveness directly impacts employee commitment, customer retention, organizational performance and ultimately, profitability. It's the "secret sauce" to fulfilling a vision. Join us for Part 3, Navigating Conflict and Fostering a Collaborative Culture!

Can't we all just get along?

arguing

When it comes to business partnerships, finding and maintaining a productive partnership can be as challenging as a marriage. Perhaps even more so given that many business partnerships are nothing more than shotgun marriages; the result of a courtship based solely on the financial merits and not much more. I liken this to marrying someone based solely on how attractive you predict the children will be, without regard to whether the two of you will be able to stay together. The refrain, “Failure is life’s greatest teacher,” speaks directly to my experience and in this regard, I have earned a PhD, having suffered through two failed business partnerships before figuring out how to enter my most recent one with the best opportunity for success. Additionally, through my advisory work I have observed many partnerships in action, brought in to assist when the partnership is going off the rails. It is usually then when most partners begin to realize the complexities of the partnership, far beyond the dollar signs they had floating in their eyes when they first came together.

When I ask partners that are experiencing conflict and potentially on the brink of collapse, “what would you have done differently?” I almost always hear the same two responses; “I would have asked a lot more questions,” and, “I would have taken more time.” And this is the crux of the issue—most people do not take enough time to truly vet the potential partnership for issues that will derail it. This happens most often because there is the rush of a deal or market timing driving the urgency, and as partners in the midst of conflict will testify, no partnership, no matter how lucrative the opportunity may appear, is worth the pain and suffering caused from premature and ill-prepared agreements.

The reality is, attempting to repair a partnership that is deep in conflict and has not done the preparatory work to set it up for success is much like trying to unscramble the omelet. Not that it can’t be done, but on a scale of difficulty, it is much larger than I can do justice here and suffice to say, often the cure kills the patient. Rather, the best opportunity for success is if you are in the early stages of formation. Following are some key steps I recommend to ensure you enter the partnership with eyes wide open and prepared for the work it will take to achieve success:

Slow down – As I’ve already stated, there is no deal so important as to overcome the poor planning of a rushed deal.

Look for a reason to say no – This sounds contrary to what you’d want, but the mindset of no is necessary to force the hard questions and rationale of, “why the partnership?” Be clear about this and force yourself to write it down. Actually, there is a whole lot more here than I have the space to write, but suffice to say it is adequately covered in David Gage’s The Partnership Charter.

Clarify roles – One of the key issues I see is that partners don’t clarify their roles “in the business” as employees, versus “on the business” as partners. There is a key distinction and clarifying when and how these roles are defined can often be the difference maker between success and failure.

Go deep on values – If they even go through the effort of defining values at all, most people short the process. It is not enough to know that all agree that integrity is a value, for example. You need to go deep, defining what behaviors define integrity, so everyone is clear what it is, and what it is not.

Define how to exit – Most partner agreements avoid this step, however force the conversation around how to value the business, or in the least, who would do the valuation, and agree on what those steps would are ahead of time.

The reality is there is no guarantee, however as the saying also goes, success favors the prepared. With patience and effort you will avoid the proverbial Rodney King moment when you are exclaiming to everyone, “Can’t we all get along?”

5/7/14 Chart of the Week: For Entertainment Purposes Only

You can find a chart that will tell you whatever you want it to: here are a couple that we will do very little with. Pascal is famous for the saying, "All of man’s misfortune comes from one thing, which is not knowing how to sit quietly in a room." And so while we are aware of some past trends, activity for activities sake is dangerous and stupid in our mind. We will wait for a bit of volatility. And be entertained along the way.