Earning estimates at the end of Q1 are much different than they were back in January. This week we explore how they have evolved over the last three months. The goal is to provide context for the proverbial headlines of "Company X beat estimates by $0.05 per share" that we are sure to hear.

4/15/14 Chart of the Week: Yesterday's Losers and Today's Winners

The rising tide does not raise all boats. In this week's conversation, Nick Fisher addresses the rotation from last year's losers into Q1's all stars.

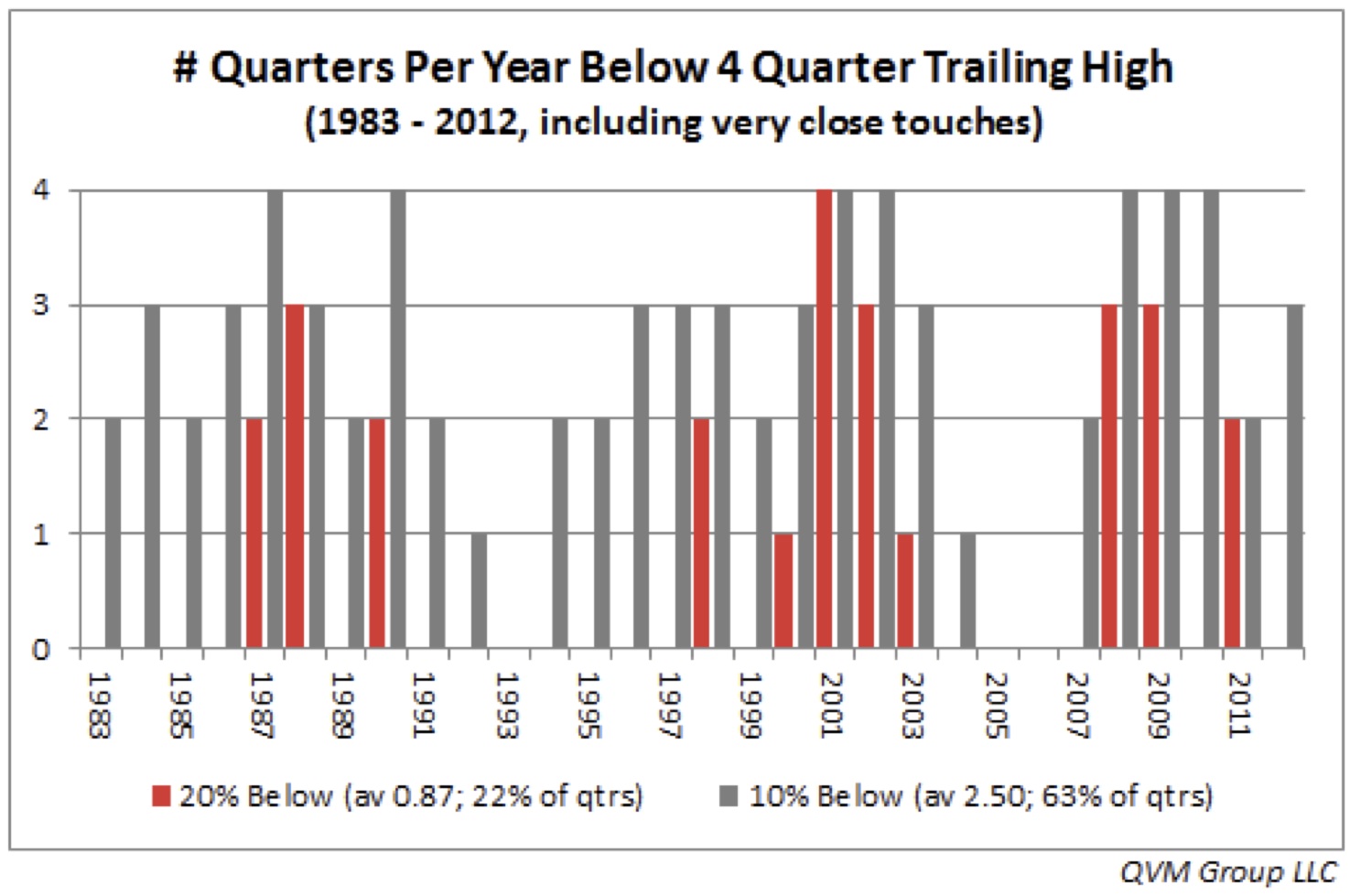

4/8/14 Chart of the Week: Market Volatility

In this week's Chart of the Week, we discuss increased volatility, how often it occurs, and what it means to investors.

4/1/14 Chart of the Week: Valuation Dispersion

In 2000, the market’s PE ratio was nearly double that of 2014. Ironically, there are less companies for sale today at valuations we are comfortable with. Learn more in this Chart of the Week with Pilot's portfolio manager, Nick Fisher.

3/25/14 Chart of the Week: Anatomy of a Bubble

Bubbles have predictable patterns: human emotions can drive asset prices to irrational levels. Understanding this can hopefully help us avoid following the lemmings off a cliff.

3/1/14 Chart of the Week: Supply and Demand - Treasury Maturities & Interest Rate Volatility

Interest rates could be quite volatile as investors digest the Treasury's need to refinance the short term maturities of our national debt.

How to Minimize Investment Returns, The Rest of the Story

In the previous posting we discussed the ridiculous layering of fees that has occurred in the investment industry. Just what one is paying for, is often disguised through a lack of transparency, accountability and general knowledge. Most advisors, provide pretty financial plans for a fee, charge an asset management fee, broker the investment making to a third party for still another fee, and then use the financial plan to sell insurance products for, you guessed it, more fees. Despite the inherent potential conflict of interest with this model, I always find it amusing that nearly every advisor I have come across, holds themselves out as, “independent” and “objective.” For reasons that may not be obvious to someone with integrity, the law rightfully doesn’t allow for investment advisors to be compensated solely based on the growth of a client’s assets. With that in mind, it is the customers (unfortunate) responsibility to find an advisor who is truly independent and who’s only compensation is as objective as possible (ie. A fee based only on the assets under management). This contrasts with the conflicted incentives an advisor can receive for selling commission based products.

Fees, Fees, Oh Man Fees!

Transparency, and disclosure are two words that are thrown around a lot, but it has been our experience that it is very difficult to truly understand the fees that an investor pays to work with an investment advisor, money manager or even direct with a mutual fund. This is the first, in a two part series intended to shed light on the investment industry. Warren Buffett (Chairman of Berkshire Hathaway) publishes an annual letter to shareholders where he gives his view of the current investment environment, as well as the operating results of the company he has piloted for the last 40+ years. These letters are archived all the way back to 1977 and are a phenomenal source of insight. The following is an excerpt from the 2005 letter and is an interesting perspective: